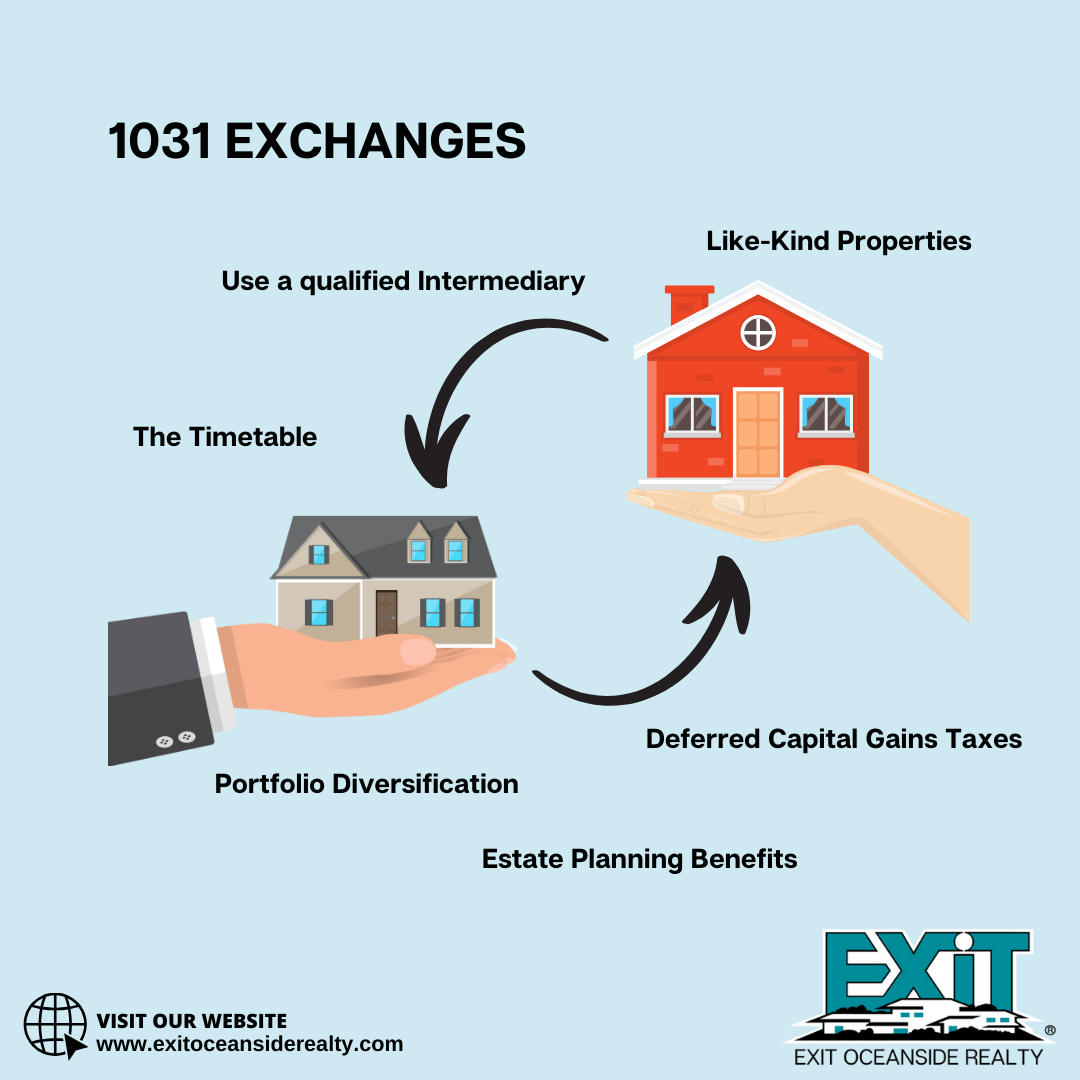

Understanding 1031 Exchanges: Tax Benefits for Real Estate Investors

Real estate investment can be a lucrative endeavor, but it frequently has tax implications. Fortunately, there are strategies that savvy investors can use to reduce their tax liabilities while increasing their returns. The 1031 exchange is one such strategy. It is a powerful tool that allows real estate investors to defer capital gains taxes by selling and reinvesting in like-kind properties. In this blog post, we will look at the complexities of 1031 exchanges and the tax advantages they provide to real estate investors.

What is a 1031 Exchange?

A 1031 exchange, named after Internal Revenue Code Section 1031, is a tax-deferral strategy that allows real estate investors to sell one property and reinvest the proceeds in another without recognizing capital gains for tax purposes. This means that rather than paying taxes on the sale profit, investors can defer those taxes and use the entire amount to purchase a new property. It is a solid way to protect your investment capital while also facilitating portfolio growth.

The Basic Rules of a 1031 Exchange

There are some important rules to follow to benefit from the tax advantages of a 1031 exchange:

1. Like-Kind Properties:

The properties being exchanged must be of the same kind. Fortunately, the IRS defines like-kind broadly, allowing a wide range of real estate investments to qualify.

2. The Timetable:

Investors must identify a replacement property within 45 days of selling the relinquished property and complete the exchange within 180 days. These deadlines are strict, so careful planning is crucial.

3. Use a Qualified Intermediary:

You cannot directly receive the sale proceeds; instead, they must be held by a qualified intermediary until you acquire the replacement property. This intermediary plays a vital role in facilitating the exchange.

Tax Benefits of a 1031 Exchange

Now, let's explore the tax benefits that make 1031 exchanges so attractive to real estate investors:

1. Deferred Capital Gains Taxes:

The primary advantage of a 1031 exchange is the ability to defer capital gains taxes. By reinvesting in like-kind properties, you can postpone paying taxes on your gains indefinitely. This means more capital is available for new investments and portfolio expansion.

2. Portfolio Diversification:

1031 exchanges allow you to diversify your real estate portfolio while avoiding immediate tax consequences. This adaptability allows you to modify your investments in response to market conditions and investment objectives.

3. Increased Cash Flow:

With the ability to defer taxes, investors can direct more funds toward the acquisition of higher-income-producing properties, increasing their cash flow and potential for wealth accumulation.

4. Estate Planning Benefits:

1031 exchanges can also be beneficial in estate planning. When an investor dies, his or her heirs receive a stepped-up basis, potentially avoiding capital gains taxes entirely.

Common Pitfalls to Avoid

While 1031 exchanges provide numerous tax advantages, investors should be aware of the following potential pitfalls:

-

Failure to Meet Deadlines: Missing the 45-day identification or 180-day exchange deadlines can result in the disqualification of the exchange.Failure to Meet Deadlines: Failure to meet the 45-day identification or 180-day exchange deadlines may result in the exchange being disqualified.

-

Inadequate Planning: Failing to plan for the exchange can limit your options for suitable replacement properties.Inadequate Planning: If you do not plan ahead of time for the exchange, you may be limited in your options for suitable replacement properties.

-

Lack of Professional Guidance: It's crucial to work with qualified professionals, including a tax advisor and qualified intermediary, to ensure a smooth exchange process.Lack of Professional Guidance: To ensure a smooth exchange process, it is critical to work with qualified professionals, including a tax advisor and qualified intermediary.

-

Non-Like Kind Properties: Ensure that the properties involved in the exchange meet the IRS definition of like-kind.Non-Like Kind Properties: Make certain that the properties being exchanged meet the IRS definition of like-kind.

Conclusion

Understanding and leveraging 1031 exchanges in the world of real estate investment can provide significant tax benefits and boost your overall returns. You can strengthen your real estate investment strategy by deferring capital gains taxes, diversifying your portfolio, and increasing cash flow. To effectively navigate the complexities of 1031 exchanges, however, careful planning and professional guidance are required. When used correctly, 1031 exchanges can be a powerful tool for real estate investors looking to increase their wealth while reducing their tax liabilities.