Mortgage Help for First-Time Home Buyers and How to Apply

Becoming a homeowner is a dream shared by many, but for first-time buyers, it can often seem like an unattainable goal, especially when it comes to saving for a down payment. The good news is that there are programs in place to help aspiring homeowners bridge this gap, and one such lifeline is Down Payment Assistance (DPA). In this article, we will explore what DPA is, how it can assist first-time homebuyers, and the steps to apply for this invaluable support.

Understanding Down Payment Assistance (DPA)

Down Payment Assistance is a financial aid program designed to help individuals and families with limited income resources make their dream of owning a home a reality. DPA programs provide grants or low-interest loans to cover a portion of the down payment and closing costs required for purchasing a home. These programs are often provided by government agencies, non-profit organizations, and sometimes even by employers as part of their benefits package.

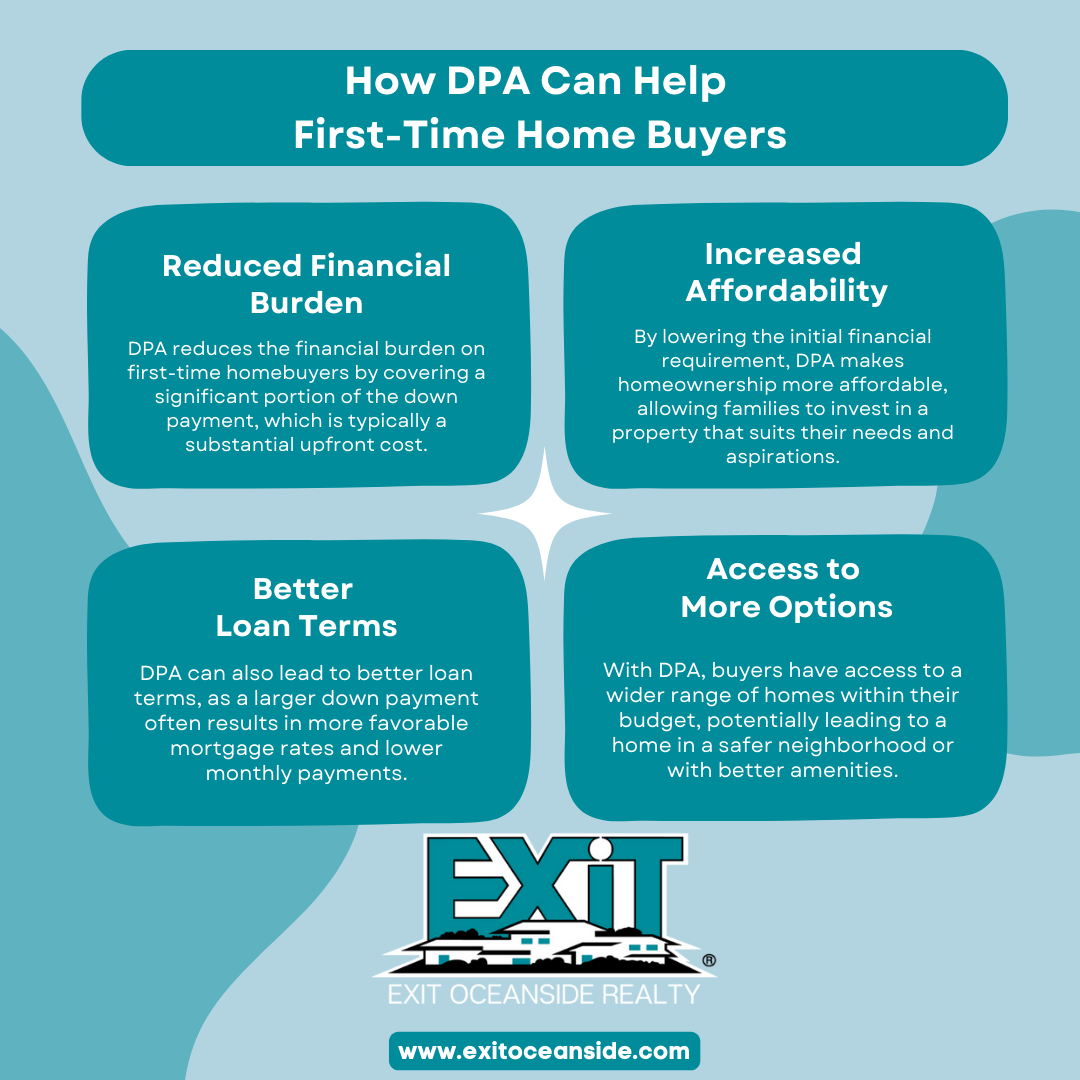

How DPA Can Help First-Time Home Buyers

1. Reduced Financial Burden:

DPA reduces the financial burden on first-time homebuyers by covering a significant portion of the down payment, which is typically a substantial upfront cost.

2. Increased Affordability:

By lowering the initial financial requirement, DPA makes homeownership more affordable, allowing families to invest in a property that suits their needs and aspirations.

3. Better Loan Terms:

DPA can also lead to better loan terms, as a larger down payment often results in more favorable mortgage rates and lower monthly payments.

4. Access to More Options:

With DPA, buyers have access to a wider range of homes within their budget, potentially leading to a home in a safer neighborhood or with better amenities.

How to Apply for Down Payment Assistance

1. Research DPA Programs:

Start by researching available DPA programs in your area. Local government websites, housing authorities, and non-profit organizations often provide detailed information about eligibility criteria and application procedures.

2. Check Eligibility:

Review the eligibility requirements of the programs you are interested in. These criteria may include income limits, credit score thresholds, and home purchase price limits.

3. Gather Necessary Documents:

Prepare the necessary documents, which might include proof of income, tax returns, employment history, and credit reports. Having these documents ready can expedite the application process.

4. Attend Homebuyer Education Courses:

Many DPA programs require applicants to attend homebuyer education courses. These courses provide valuable insights into the homebuying process and financial management, helping applicants make informed decisions.

5. Submit Your Application:

Carefully fill out the application forms and submit them along with the required documents. Double-check to ensure that all information provided is accurate and up-to-date.

6. Follow Up:

After submitting your application, follow up with the relevant agency to track its progress. Be prepared to respond promptly to any requests for additional information.

7. Stay Informed:

Stay informed about the status of your application and be proactive in seeking updates. This demonstrates your genuine interest and commitment, which can positively influence the decision-making process.

Conclusion

Down Payment Assistance programs serve as a beacon of hope for first-time homebuyers, paving the way for them to achieve the cherished milestone of homeownership. By understanding the process and diligently following the steps to apply, aspiring homeowners can significantly increase their chances of receiving the support they need. With DPA, the dream of owning a home becomes not just a possibility, but a tangible and achievable reality for countless families across the country.