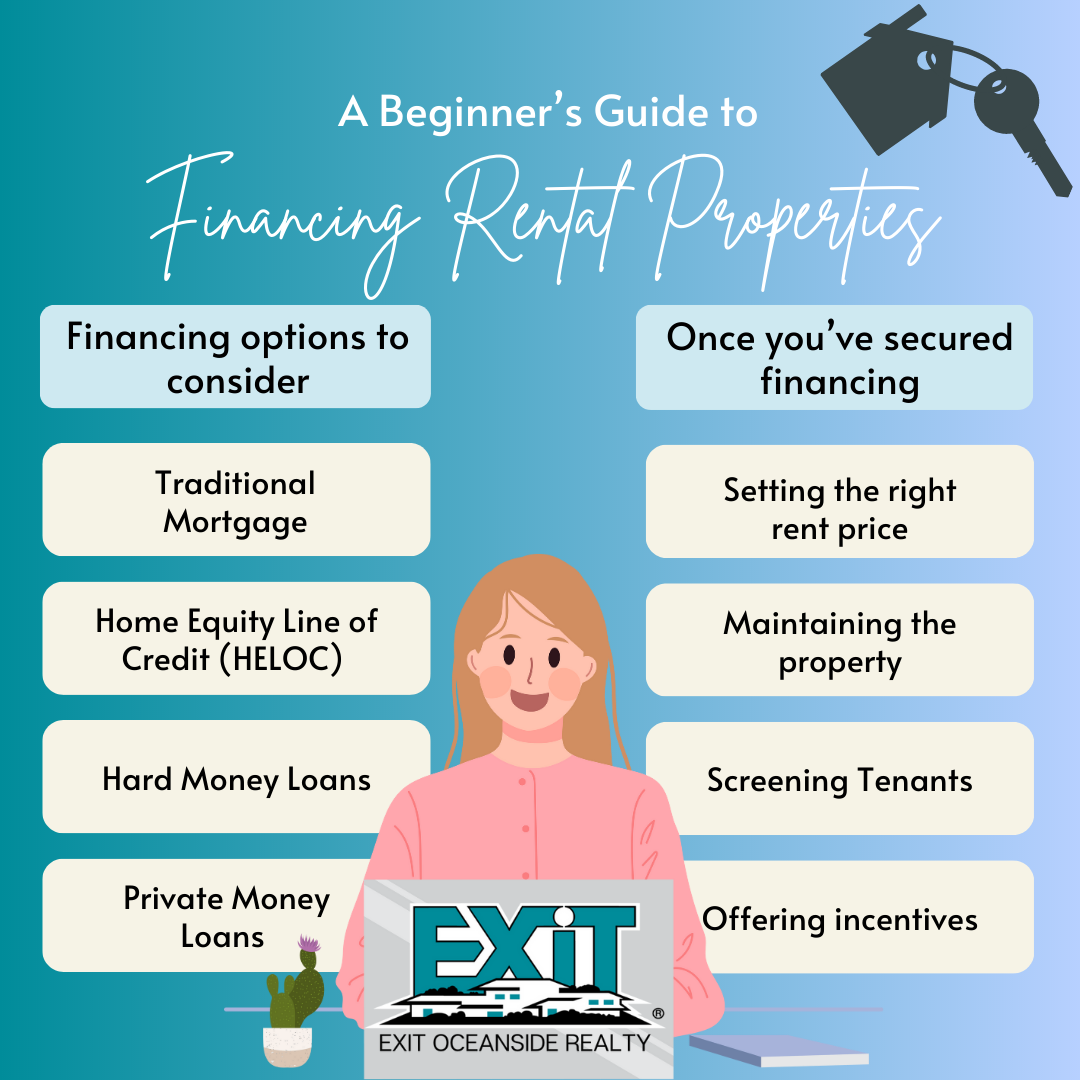

Maximizing Profits: A Beginner’s Guide to Financing Rental Properties

Maximizing Profits: A Beginner’s Guide to Financing Rental Properties

Are you considering investing in a rental property but need help financing it? Investing in a rental property can be a lucrative source of passive income. Still, it’s essential to understand your financing options and make informed decisions to ensure your investment is profitable.

Here are some financing options to consider:

-

Traditional Mortgage: A conventional mortgage is a common way to finance a rental property. You can either use a traditional mortgage or an investment property loan. The down payment can be as low as 20%, but you will need a good credit score and a stable income to qualify.

-

HELOC: A home equity line of credit (HELOC) allows you to borrow against the equity in your primary residence to finance a rental property. The option typically has a lower interest rate than a traditional mortgage, but you must have sufficient equity in your home to qualify.

-

Hard money loans: Real estate investors who need to move quickly frequently use short-term loans called hard money loans. Typically, the interest rates and fees are higher than those of conventional mortgages, but they are easier to obtain.

-

Private money loans: Private money loans are similar to hard money loans, but the lender is a private individual or group rather than a financial institution. The loan terms are negotiable, but the interest rates are typically higher.

Once you’ve secured financing, it’s essential to maximize your profits by:

-

Setting the right rent price: Research comparable properties in the area to determine a fair price to attract tenants and cover your expenses.

-

Maintaining the property: Regular maintenance and repairs will help you avoid costly repairs down the line and keep your tenants happy.

-

Screening Tenants: A thorough screening process will help you avoid problematic tenants who may not pay rent on time or cause damage to the property.

-

Offering incentives: such as free rent for the first month or a rent discount for lease renewal, can aid in attracting and retaining quality tenants.

Investing in rental properties can be a profitable venture, but it’s essential to understand your financing options and take steps to maximize your profits. With the right approach, you can enjoy the benefits of passive income and build long-term wealth.

Please share this blog post with your friends who have an interest in real estate investments.